Let’s see what’s in the news today.

Crop insurance to see growth from 2024 onwards, govt tech push to boost sector: Eco Survey

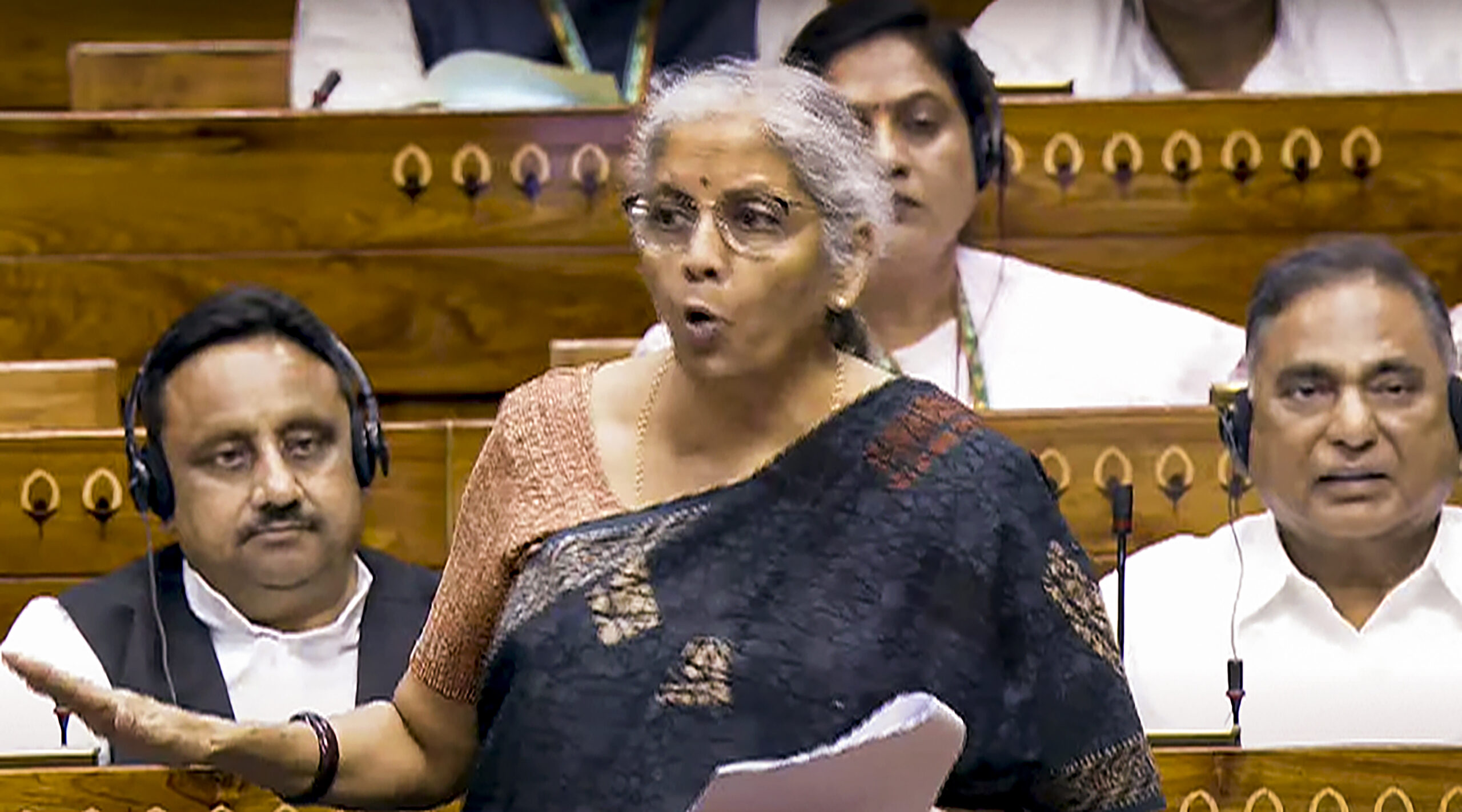

New Delhi, Jul 22 (PTI) The agriculture insurance sector is likely to register growth from 2024 onwards, with an average real premium growth of 2.5 per cent over the medium term, according to the Economic Survey 2023-24. The survey, tabled in Parliament on Monday, noted that agriculture insurance, accounting for about 12 per cent of […]

Read the original article here

Economic Survey 2023-24: Crop insurance to see growth from 2024 onwards, government tech push to boost sector

Economic Survey 2023-24: Agriculture insurance sector to grow post-2024 with 2.5% premium growth, supported by technological advancements and government initiatives.

Read the original article here

Trigger Warning: Cyber Policy Wordings to Impact Coverage for Tech Outage

Industry stakeholders continue to try to get a grasp of the implications from last week’s massive technology outage affecting motley industries around the

Read the original article here

Buzz over likely applicants for digital insurance licences

FINTECH (financial technology) and insurtech (insurance technology) firms, as well as a few established digital insurers in the region, are seen as the likely applicants for a digital insurance or takaful operator licence in Malaysia, experts say.

Applicants may include PolicyStreet (an…

Read the original article here

Selective Insurance and One Inc partner to revolutionise claims payment process

One Inc, the leading digital payments network for the insurance industry, has announced that Selective Insurance, a prominent business, home, and auto insurer, has selected its ClaimsPay® digital payment solution.

Read the original article here