Let’s see what’s in the news today.

Shallow, deepfakes could impact insurance claims

Are deepfakes threatening the insurance industry? Some experts suggest a second layer of verification may be needed to combat altered materials in claims processing.

Read the original article here

The untapped potential of smart-home insurance solutions

Tech-enabled risk mitigation improves insurance customer experiences. A recent panel talked about how to make it more mainstream.

Read the original article here

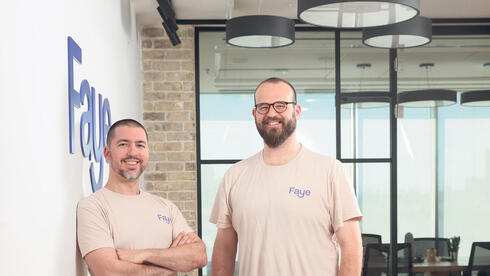

“For Americans, Faye has become part of their passport”

Insurtech company Faye is disrupting the American travel insurance world, which has only begun to wake up in recent years. Founders Elad Schaffer and Daniel Green say that comparisons to other insurtech companies like Lemonade are inaccurate: “We have an opportunity to innovate in a market that hasn’t seen innovation in years”

Read the original article here

InsurTech unicorn Go Digit General Insurance to launch IPO to raise funds

Go Digit General Insurance, a leading InsurTech unicorn backed by major investors, has launched its initial public offering (IPO) to raise funds for strengthening its solvency ratio and capital reserves.

Read the original article here

CoverTree: $13 Million Secured To Develop Manufactured Home Insurance Solutions

CoverTree, an insurtech company specializing in manufactured home insurance solutions, announced the completion of a $13 million Series A funding round led by Portage, with participation from investors like AV8, Distributed Ventures, Detroit Venture Partners, Ludlow Ventures, Annox Capital, and others.

Read the original article here