TLDR:

- Sureti, an insurance tech startup, is revolutionizing claims payments with a streamlined platform.

- CFM Insurance is partnering with sureti to offer a completely digital and lenderless settlement experience for policyholders.

Insurance tech startup sureti is changing the game with its streamlined claims payments platform. The company recently announced a partnership with Missouri mutual insurance provider, CFM Insurance, to offer its technology to policyholders. This move allows for a completely paperless and lenderless settlement experience, revolutionizing the insurance claims disbursement system. Sureti is at the forefront of the growing insurance tech (insurtech) sector, striving to modernize and propel the industry forward.

CFM Insurance’s commitment to embracing innovation and providing a smooth experience for policyholders has led to the adoption of sureti’s platform. By reducing steps and accelerating the time from damage to repairs, CFM aims to deliver outstanding results for their membership. This partnership highlights the benefits of sureti’s service for a wide range of insurance providers, from community-based carriers to national companies.

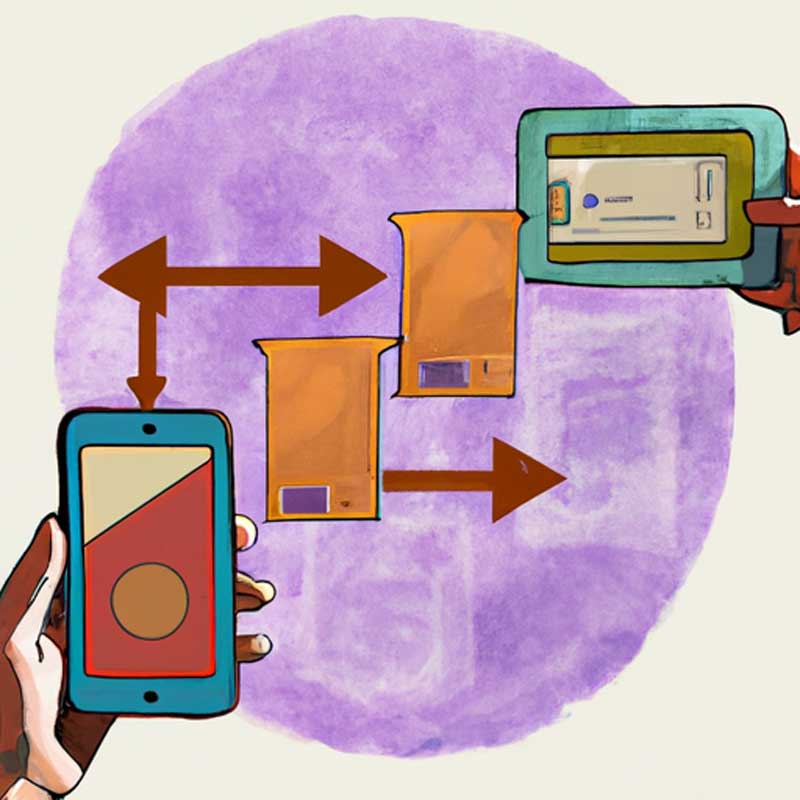

Sureti’s platform addresses the antiquated payment system prevalent in the insurance industry, where nearly 90% of property insurance payments are still issued with paper checks. By developing digital endorsements for multi-party claim payments and a geospatial capture mechanism for verifying job site progress, sureti eliminates the need for paper checks and field inspectors. This streamlined approach enables payments directly to vetted contractors while observing mortgage lenders’ rights as first lienholders.

Looking ahead, sureti anticipates significant growth in 2024, with plans to expand its partnerships and enhance claim outcomes in the property insurance ecosystem. The company’s collaboration with CFM Insurance and other providers like Branch Insurance demonstrates the industry’s recognition of the value and efficiency of sureti’s payment rails. As a leader in the insurtech space, sureti is poised to continue transforming the insurance claims process for the better.